Digging Deep into Who Struggles to Afford Housing in Your Region

by Janet Viveiros, National Housing Conference

Most Americans know there are gaps between what housing costs and what people can afford. Many know this firsthand from their struggles to make their rent or mortgage payment each month, others know it secondhand from watching friends and families struggle, and others simply hear news stories about how housing costs in New York City or San Francisco have reached new highs.

Despite a general and widespread acknowledgement of affordable housing challenges, most policymakers and members of the public do not know how dramatic the gaps are between what people earn and what they can afford, particularly outside high-cost regions. A recent webinar from the National Housing Conference (NHC), “Paycheck to Paycheck: More than Housing,” explored these housing affordability gaps, showing that workers struggle with housing costs even in relatively low-cost areas. For example, few people think about Midwestern metro areas like Gary, Indiana, or Detroit, Michigan, as being places where workers

face serious housing affordability challenges, yet for many workers, housing costs are unaffordable even in these low-cost metro areas.

The webinar also shared these key findings from the NHC’s recent supplement to the data tool, “More than Housing:”

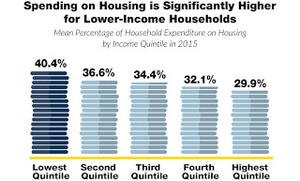

- Housing costs comprise a significantly higher percentage of income for low-income households compared with high-income households.

- Low-income renters spend relatively more of their income on housing than low-income homeowners.

- Both renters and owners are more likely to encounter major housing affordability challenges in and around major cities along the East and West Coasts.

The housing affordability picture changes when you look at typical earnings and housing costs in the context of other household costs. Many working households cannot make ends meet when you add up all their expenses. For example, a Colorado family of four with a combined monthly income of $4,749 could fall short of paying for necessary household expenses by $1,032 each month.

The Paycheck to Paycheck data tool and the “More than Housing” supplement help policymakers and the public visualize how incomes often fall short of what households need to afford their rent or mortgage while having enough left for food, transportation, health care, and more. By increasing this knowledge, I hope to spur more thinking about how communities and the federal government can ensure affordable housing for workers across the income spectrum.

An earlier version of this post was initially published on the NHC Open House blog. Janet Viveiros is the acting director of research at the National Housing Conference.