Rent Reporting Can Help Build Credit. Why Aren’t Smaller-Property Tenants Opting In?

This post was originally published on Urban Wire, the blog of the Urban Institute.

On-time rent payments have long been excluded in mortgage underwriting, despite their high potential to predict future mortgage payments. Following many years of discussion in the mortgage industry, most credit scoring models are finally incorporating these data.

Recently, there have been some movements to improve rent reporting. For example, Fannie Mae and Freddie Mac have begun providing free or substantially discounted rent reporting services to landlords of their multifamily properties to entice them to offer the options to tenants. And several start-ups, including Esusu and Bilt, are providing rent reporting services to landlords and tenants.

Still, only a small fraction is being reported to the credit bureaus, limiting most renters’ access to mortgage credit. And most landlord-based rent reporting services are happening in the multifamily space, largely leaving out smaller landlords and their tenants.

We find that many renters living in smaller rental units, who need to individually apply for rent reporting and pay the cost, misunderstand how this works, further lowering the likelihood of rent being included in the recent credit scores. We’re partnering with Avail, an online platform that helps mom-and-pop landlords manage their rental properties (most of which are one-to-four-unit rentals), including listings, tenant screening, and rent collection, to learn more about this large swath of the rental market. Avail also provides a service for reporting on-time rental payments to TransUnion, one of the three large credit bureaus, for tenants who elect to pay a $4.95 monthly service fee. We analyzed Avail’s December 2023 Tenant Survey among 2,241 tenants to examine how tenants living in mom-and-pop properties report their rent payments to the credit bureaus.

Our biggest surprise is that most tenants not taking advantage of the rent reporting service don’t know whether their rent is being reported to the credit bureaus. Many believe their credit score is already affected by their rent payments, pointing to a high level of misinformation in this space.

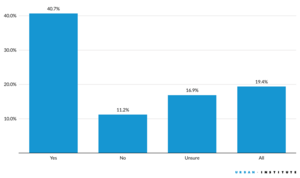

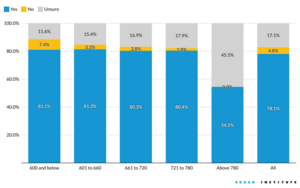

Most tenants don’t know whether their rent is being reported

When asked whether their rent was being reported to the credit bureaus to inform their credit score, a plurality of renters said they were unsure. These results were constant across age ranges and incomes. A small silver lining is that more borrowers most likely to see credit score increases (those with scores below 600 and from 601 to 660) were more certain their rent was being reported.

Most Tenants Are Not Reporting Rents, But Those With Lower Credit Scores Are More Likely To Do So

Source: Avail December 2023 Tenant Survey.

Even among those who said their rent was reported to the credit bureau, about a third said they did not know which tool was being used to report their rent.

Unless tenants of mom-and-pop properties proactively select and use services to report their rent, it is highly unlikely their rent will be reported to the credit bureaus. This suggests there are people who mistakenly believe their rental payments are being reported when they are not.

Some tenants are unaware that on-time payments don’t automatically increase their credit score

More than a third of the tenants said they experienced an increase in their credit score in the past 12 months, and among who said their rent was being reported, on-time rental payment was the most mentioned reason.

But the survey showed some people attributed their credit score increase to rent reporting when they either were not reporting rent or were unsure about their rent reporting, indicating a lack of awareness about how rent reporting and the current credit scoring system—which is largely a black box—works (only the most recent scoring models account for rent payments and only for those who report their rent to the credit bureaus).

Some Tenants Who Don't Report Rent Believe On-Time Payments Raise Their Credit Score

Source: Avail December 2023 Tenant Survey.

Notes: Respondents who said their credit score increased.

Many tenants say there are benefits of rent reporting, and most of those who report say they will continue to do so

More than half of respondents believe there are benefits to reporting on-time rent payments to the credit bureaus. Those who reported rent payments were more likely to say there is a benefit to rent reporting (78 percent).

But even among those who said they were not reporting or were unsure, the highest share of respondents believed rent reporting has benefits (48 percent and 43 percent, respectively).

More revealing, 78 percent of those who say they report rent payments said they would plan to continue, reflecting their satisfaction with rent reporting. Those who plan to continue rent reporting were higher among those with lower credit scores, who also had a higher share of those who believed in the benefits of rent reporting.

Most Tenants Who Report Rent Said They Will Continue To Do So

Source: Avail December 2023 Tenant Survey.

Notes: Respondents who said they report rent to credit bureaus.

How to promote rent reporting

Though there is a positive correlation between on-time rent payments and credit scores, particularly for those with low scores, that message is not reaching renters. Currently, less than 5 percent of all tenants’ rent payments are being reported to the credit bureaus (and the figure would be lower for renters in small buildings).

But about 9 percent of survey respondents said they were reporting rent through the Avail platform, showing that some tenants who are aware of rent reporting’s benefits are willing to report their rent even with some associated cost. Avail’s website also explains the benefits of rent reporting, which could have enhanced consumers’ understanding compared with tenants overall.

There is clearly a need to increase consumer awareness. The US Department of Housing and Urban Development (HUD) could provide this information in its regional house parties, where they share information about what it takes to buy a home, with a focus on targeting younger people (who are likely to have lower credit scores). Housing counselors, financial literacy organizations, or legal aid organizations also have a role to play in educating renters on the benefits of rent reporting. But enhanced awareness may not be enough for tenants with lower incomes, for whom even a small cost to report could be too great a burden and outweigh the benefit.

In many multifamily units, more services are becoming available to report rent to all three credit bureaus. But because each credit bureau requires different documents to report rent, individual tenants and small landlords will be slower to adopt the practice. To help some of these tenants, HUD could consider requiring landlords participating in the Housing Choice Voucher (HCV) Program—which supports 2.3 million households with low incomes—to report positive rent payments and authorize local housing authorities that administer HCV programs to pay for rent reporting out of their administrative fees.

Increasing efficiency and lowering the cost of rent reporting to all tenants through technology and standardization will also be key to improving participation. The Consumer Data Industry Association has worked with the credit bureaus and other stakeholders to release a standard for residential rent accounts, marking meaningful progress.

Ultimately, expanding rent reporting will improve renters’ credit and make homeownership a reality for many more households.