clubfoto, Getty Images

How Can Manufactured Housing Address the Affordable Housing Crisis?

Long-standing housing supply shortages (PDF) nationwide have driven policymakers to consider expanding manufactured housing to increase the affordable housing stock. Manufactured housing (MH) costs much less than site-built housing but is much less common.

Recently, policymakers at the local, state, and federal levels have expressed interest in expanding manufactured housing to help solve the problem. But to create the most-effective solutions to the dual housing and affordability crises, policymakers need up-to-date data. We analyzed the latest manufactured housing data in 2025 from the Federal Housing Finance Agency Home (FHFA) Price Index, the Manufactured Housing Survey, the Home Mortgage Disclosure Act data release, and the American Community Survey.

Here are four considerations for policymakers:

Manufactured housing prices have appreciated at the same rate as site-built homes.

One of the notable trends was the strong home price appreciation of manufactured homes. Many Americans still believe that manufactured homes do not appreciate at the same rate as site-built homes. This negative perception has led some local governments to restrict manufactured housing in their communities and have made some potential homeowners less likely to purchase manufactured homes. However, recently released data from the FHFA Housing Price Index provides strong evidence that this negative perception of home price appreciation is false.

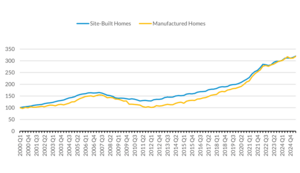

From Q1 2000 to Q2 2025, real property manufactured homes and site-built homes appreciated at nearly the same rate, increasing 219.1 percent for manufactured homes and 219.9 percent for site-built homes. And in the past decade, manufactured homes have seen higher year-over-year increases than site-built homes in nearly every quarter.

Purchase-Only Home Price Index for Traditional Site-Built and Manufactured Homes

Source: Federal Housing Finance Agency Q2 2025 Home Price Index.

Note: Quarterly data run from Q1 2000 to Q2 2025. Series are indexed to Q1 2000.

Manufactured housing remains a key source of lower-cost housing, despite challenges.

Other key findings from the 2025 Manufactured Housing Survey show manufactured homes significantly boost the affordable housing stock. In 2024, manufactured housing production contributed to 10.2 percent of new single-family home supply, with around 103,314 homes shipped nationwide. The average sales price of a new manufactured home, excluding the price of land, stood at just $124,800 compared with around $424,176 for a new site-built home in 2024. The stark price difference between manufactured and site-built homes is noteworthy, as the median income for households living in manufactured homes was $46,000 compared with around $80,000 for those living in site-built homes in 2023.

Financing manufactured housing still has several challenges in both access and affordability.

Financing for manufactured homes continues to be challenging, with higher mortgage interest rates and significantly higher mortgage denial rates than loans for site-built homes. According to loan data from the 2024 Home Mortgage Disclosure Act, mortgage applications for MH mortgage loans were denied at a 57.8 percent rate and MH personal property loans at a 65.3 percent rate compared with just 10.0 percent for site-built home mortgage loans. In addition to greater difficulties in accessing financing for an MH loan, the loan terms for those who do obtain financing are often worse for MH borrowers and worsen affordability challenges. For example, the median interest rate stood at 7.88 percent for originated MH mortgage loans and 9.50 percent for MH personal property loans, substantially higher than a median rate of 6.63 percent for site-built home mortgage loans in 2024.

Further data refinements could aid policymakers.

Although these publicly available datasets provide users with a robust suite of variables on manufactured housing, the definition of manufactured housing and what it encompasses needs to be standardized.

For example, the other datasets directly label manufactured homes as such in their data, but the US Census Bureau still labels manufactured homes in the American Community Survey as “mobile homes or trailers” despite the outmoded terminology. The Housing Act of 1980 mandated the term “manufactured” be used in place of “mobile” (PDF) in all federal laws and literature that referenced homes built after a major US Department of Housing and Urban Development code reform in 1976. The term “mobile home” often carried stigma surrounding product quality, as homes built in 1976 or earlier often resembled campers or trailers that could be easily moved if needed.

In addition, conducting new surveys with timely questions can help fill knowledge gaps. Pew Research Center’s 2022 Manufactured Housing Survey (PDF) captured new information not typically found in publicly available datasets, including data on the titling conversion process, payment delinquencies, living conditions, and more. Other useful data that could contribute to policy discussions and decision-making may include information on the homebuying process and dealer channel, loan performance and loss severity, and the ways zoning laws and regulations vary and align by locality.

As policymakers turn to manufactured housing to address part of the national housing shortage, the latest data from the Census Bureau, the Consumer Financial Protection Bureau, and the Federal Housing Finance Agency provide important insights into the nature of the manufactured housing, its market, and those who make it their home.